Strata communities, comprising residential, commercial, or mixed-use properties, often encounter financial challenges. From unexpected repairs to long-term maintenance, these communities require stable funding mechanisms to ensure their sustainability.

Thankfully, companies like Lannock Strata Finance offer a lifeline to strata communities in terms of flexible funding, enabling them to tackle maintenance projects, undertake renovations, and address unforeseen emergencies confidently and quickly. This article explores the significance of flexible funding and its impact on the financial resilience of strata communities.

Challenges Faced by Strata Communities:

Strata communities often face financial challenges due to diverse factors such as aging infrastructure, compliance requirements, and economic fluctuations. Common issues include inadequate reserve funds, delayed maintenance, and difficulty obtaining financing for capital projects. These challenges can compromise the safety, functionality, and value of the properties within the community.

The Role of Flexible Funding:

Flexible funding solutions offer strata communities a viable means of addressing their financial needs without resorting to significant increases in levies or special assessments. These funding options are designed to accommodate the diverse requirements of strata properties, providing access to capital for various purposes, including:

Major Repairs and Renovations:

Flexible funding allows strata communities to undertake major repairs or renovations essential for maintaining the integrity and attractiveness of the property. Whether addressing structural issues, upgrading facilities, or enhancing energy efficiency, access to funds ensures the timely completion of critical projects without imposing undue financial strain on owners.

Emergency Expenses:

Unforeseen emergencies such as storm damage, plumbing failures, or security breaches can significantly impact strata communities. Flexible funding enables swift response to such crises, facilitating prompt repairs or mitigation measures to minimise disruptions and safeguard the well-being of residents and assets.

Sustainability Initiatives:

In an era of increasing environmental awareness, strata communities are exploring sustainable practices and technologies to reduce their ecological footprint and operating costs. Flexible funding supports initiatives such as solar panel installations, energy-efficient upgrades, and water conservation measures, empowering communities to embrace sustainability while enhancing long-term financial sustainability.

Compliance Requirements:

Strata properties must adhere to various regulatory standards and compliance obligations, ranging from building codes to fire safety regulations. Flexible funding assists communities in meeting these requirements by funding necessary inspections, upgrades, and remediation efforts, thereby ensuring legal compliance and mitigating potential liabilities.

Benefits of Flexible Funding:

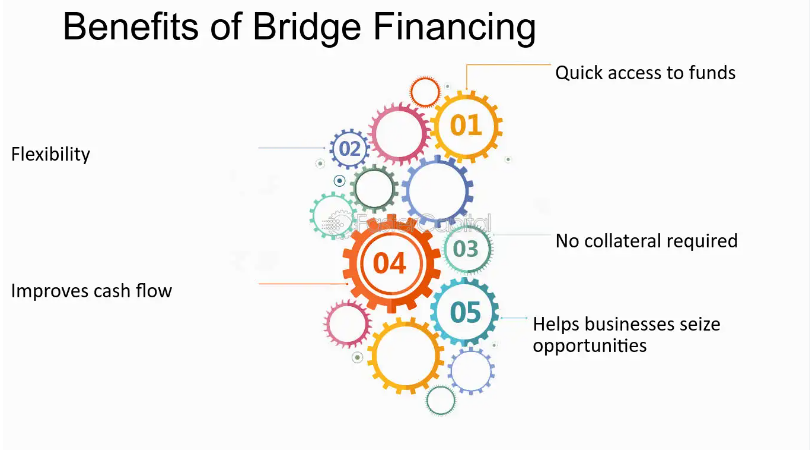

The adoption of flexible funding solutions offers several benefits to strata communities, including:

Financial Stability:

By providing access to capital when needed, flexible funding enhances the financial stability of strata communities, enabling them to address maintenance and improvement needs without depleting reserve funds or resorting to ad-hoc levies.

Enhanced Property Value:

Investing in essential repairs, renovations, and sustainability measures not only improves the quality of life for residents but also enhances the overall value of strata properties. Well-maintained and efficiently managed communities are more attractive to prospective buyers and tenants, translating into higher property values and rental yields.

Community Satisfaction:

Timely resolution of maintenance issues and implementation of improvement projects contribute to greater satisfaction among residents, fostering a sense of pride and belonging within the community. Transparent communication regarding funding decisions and project outcomes further strengthens trust and cohesion among owners and stakeholders.

Risk Mitigation:

Flexible funding strategies mitigate the risk of financial distress resulting from unexpected expenses or prolonged neglect of maintenance issues. By proactively addressing challenges and investing in asset preservation, strata communities can minimise the likelihood of costly emergencies and legal disputes in the future.

Flexible funding by companies like Lannock Strata Finance plays a pivotal role in bridging financial gaps within strata communities, enabling them to address diverse needs and challenges effectively. By adopting innovative financing solutions tailored to their specific requirements, strata properties can enhance their financial resilience, sustainability, and overall well-being. Embracing a proactive approach to financial management ensures that strata communities thrive in the face of evolving demands and uncertainties.